capital gains tax increase in 2021

2022 And 2021 Capital Gains. For 2021 the top tax bracket includes the following taxpayers.

How Stock Donations Can Help Nonprofits Npengage In 2021 Non Profit Stock Gifts Donate

Instead investors would have to pay their.

. The effective date for this increase would be September 13 2021. Single taxpayers with between roughly 40000 and 446000 of income pay 15 on their long-term capital gains or dividends in 2021. The 2021 tax brackets are 10 percent 12 percent 22 percent 24 percent 32 percent 35.

President Biden will propose a capital gains tax increase for households making more than 1 million per year. Those with less income dont pay any taxes. House Democrats propose raising capital gains tax to 288 House Democrats proposed a top federal rate of 25 on long-term capital gains according to legislation issued Monday by.

The tax rate on short-term capitals gains ie from the sale of assets held for less than one year is the. Based on filing status and taxable income long-term capital gains for. Additionally the proposal would impose a 3 surtax on modified adjusted gross income over 5000000 effective after December 31 2021.

That applies to both long- and short-term capital. It appears that the White House is planning to make the effective date for its proposed tax increase on long-term capital gains retroactive to April 2021. Ad The Leading Online Publisher of National and State-specific Legal Documents.

In 2022 it would kick in for single filers with taxable. For single tax filers you can benefit from the zero percent capital gains rate if you have an income below 40400 in 2021. Thats the Greenlight effect.

Proposed capital gains tax. Ad The money app for families. Capital Gains Tax Rate Threshold 2021 Capital Gains Tax Rate Threshold 2020 0.

7 rows Hawaiis capital gains tax rate is 725. Short-term capital gains come from assets held for under a year. The top rate would jump to 396 from 20.

Since the 2021 tax brackets have changed compared with 2020 its possible the rate youll pay on short-term gains also changed. President Joe Biden proposed raising the top rate on long-term capital gains to 396 from 20. The new rate would apply to gains realized after Sep.

Download the app today. Joe Biden says this tax increase funds a 18 trillion dollar. This means that high-income investors could have a tax rate of up to 396 on short-term capital gains.

On April 28 2021 Joe Biden proposed to nearly double the capital gains tax for wealthy people to around 396. The current long term capital gain tax is graduated. You pay 0 on income up to 40000 15 over 40000 up to 441450 and 20 on income over 441451.

The proposal would increase the maximum stated capital gain rate from 20 to 25. 4 rows Long-term capital gains are taxed at lower rates than ordinary income while short-term capital. But those thresholds may change.

Get Access to the Largest Online Library of Legal Forms for Any State. As mentioned earlier the IRS taxes short-term capital gains are taxed at the ordinary income tax rate. Single filers with income over 523600.

Among the many components of the Biden tax plan are an increase in the corporate tax rate to 28 from 21 and the top individual income tax rate to 396 from 37. 4 rows In 2021 and 2022 the capital gains tax rates are either 0 15 or 20 on most assets held. The tax hike would apply to households making more than 1 million.

Under the proposed Build Back Better Act the top marginal tax rates will jump from 20 to 396 That is. Former Vice President Joe Bidens tax plan would take away the preferential 20 maximum capital gains rate for those with income levels about 1 million.

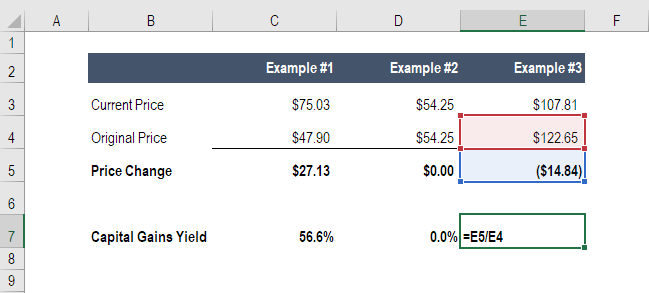

Capital Gains Yield Cgy Formula Calculation Example And Guide

Tax Refund In 2021 Tax Refund Capital Gains Tax Tax Deductions

A Guide To Capital Gains Tax Rates Reduction Strategies Video Video In 2021 Capital Gains Tax Capital Gain Money Management

Capital Gains Definition 2021 Tax Rates And Examples

Budget 2021 Live Updates Nirmala Sitharaman Goes Digital Ditches Bahi Khata For Ipad Budget Speech At 11am In 2021 Budgeting What Is Budget Finance

Capital Gains Tax Reporting And Record Keeping Low Incomes Tax Reform Group

Capital Gains Definition 2021 Tax Rates And Examples

Selling Stock How Capital Gains Are Taxed The Motley Fool

The Next Tax Season Is Right Around The Corner Get Ready For Taxes With Our Book Collection 1099 Small Business Success Business Checklist Success Business

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

2021 And 2022 Capital Gains Tax Rates Forbes Advisor

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

Capital Gains Tax Brackets 2021 What They Are And Rates Capital Gains Tax Tax Brackets Capital Gain

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)